Gartner’s latest Magic Quadrant for Software Asset Management (SAM) offers more than just a snapshot of market leaders—it reveals a deeper story about the evolving dynamics of the SAM ecosystem. At first glance, the quadrant is a familiar landscape of vendors, resellers, and audit firms. But beneath the surface lies a critical question: Can software asset management truly be effective when driven by entities with conflicting interests?

The Power Players: Consolidation and Control

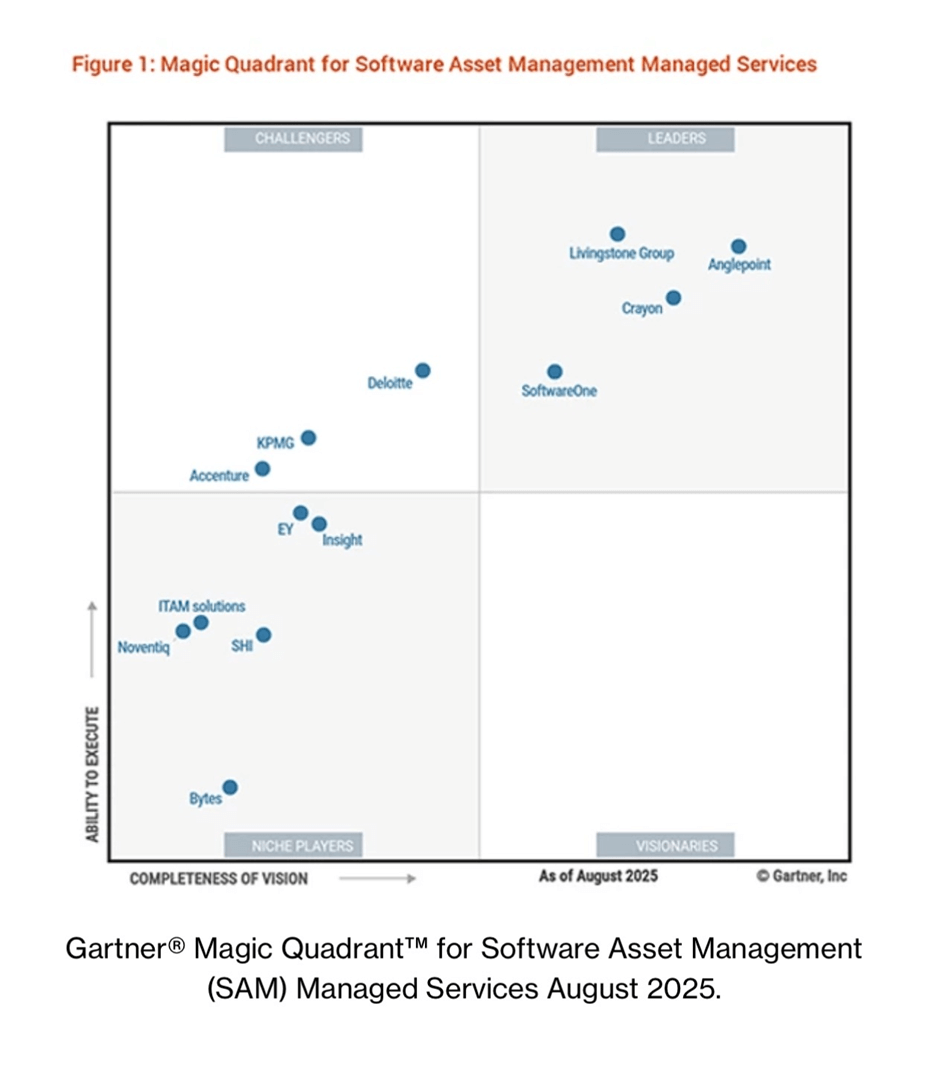

In the coveted top-right “Leaders” quadrant, SoftwareOne stands out—not just for its capabilities, but for its strategic acquisitions. Having acquired Crayon, which in turn holds a majority stake in Anglepoint, SoftwareOne is building a formidable SAM empire. The potential integration of these three could reshape the SAM landscape, but it also raises questions about independence. If a single entity controls multiple layers of SAM services, where does the client’s best interest sit?

Similarly, Livingstone, owned by Trustmarque, is another leader. Trustmarque’s merger with Ultima, announced 23rd October 2025, adds further scale and capability to the group. But again, we see a trend: consolidation of SAM services within reseller-driven organisations.

Niche Players and Reseller Realities

In the bottom-left “Niche Players” quadrant, we find familiar names: Insight, SHI, Bytes, and Noventiq. All are software resellers. Even Accenture, listed as a “Challenger,” operates a reseller arm. This pattern is telling. Resellers, by nature, aim to sell more software.

This leads to a fundamental conflict: Can a reseller driven SAM provider truly prioritise cost reduction and compliance when their revenue depends on selling more licenses?

The Auditors: Partners or Gatekeepers?

Then there are the audit firms—Deloitte, KPMG, and EY—who partner with software vendors to perform compliance checks. While their role is critical, their partnerships with vendors may limit their objectivity. They’re not incentivised to reduce spend; they’re incentivised to ensure compliance, often in ways that benefit the vendor.

Independence: The Missing Piece

At its core, Software Asset Management should be about:

- Managing licenses effectively

- Reducing unnecessary spend

- Ensuring compliance without bias

When SAM is driven by resellers or vendor aligned auditors, these goals can become secondary. That’s why independent SAM is not just a preference—it’s a necessity.

An independent SAM provider has no stake in selling software or pleasing vendors. Their sole focus is on the client’s best interest: optimising usage, avoiding penalties, and making informed decisions. Independence fosters transparency, trust, and true value.

Final Thought: Who Do You Trust With Your Assets?

As the SAM landscape continues to consolidate, clients must ask themselves:

Do I want my software assets managed by someone who profits from selling me more software?

Or, do I want a partner whose only goal is to help me spend less and stay compliant? If so, contact us at The SAM Club. We have a proven track record of savings our clients money whilst remaining compliant.